National Transfer Accounts: Understanding the Generational Economy

The goal of the National Transfer Accounts (NTA) project is to improve understanding of how population growth and changing population age structure influence economic growth, gender and generational equity, public finances, and other important features of the macro-economy. Research teams in more than 60 countries are constructing accounts that measure how people at each age produce, consume, and share resources, and save for the future. These accounts are designed to complement the UN System of National Accounts, population data, and other important economic and demographic indicators.

The NTA project is shedding light on many areas of importance to policymakers:

- Public policy on pensions, health care, education, and reproductive health

- Social institutions, such as the extended family

- The full economic contribution of women

- Social, political, and economic implications of population aging

| GO TO: DATABASE, INDICATORS, APPLICATIONS | GO TO: PUBLICATIONS, SPECIAL PROJECTS |

| oooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo | ooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooo |

| GO TO: METHODS, WORKSHOPS, NTA COURSE | GO TO: CONFERENCES, MEMBERS, GOVERNANCE |

What's New

The Fourth NTA Africa conference will be held from July 28-30, 2026 in Saly, Sénégal

The Generational Economy and Care Economy at the Heart of Public Policies in Africa

Concept Note: NTA_Africa_4_concept_note

Call for Papers: NTA_Africa_4_call_for_papers

Conference website: https://ntaafrica-conference-edition4.creg-center.org/

Policy and the Generational Economy: The 15th Global Meeting of the NTA Network, Centara Grand Hotel & Convention Centre, Bangkok, Thailand, March 10-13, 2025

Time Series Indicators: 2024 Revision

The NTA Indicators have been updated incorporating the 2022 UN Population Projections. NTA Indicators contain time series indicators for over 180 countries.

Interactive Data Explorer

The new NTA Interactive Data Explorer has just been released. The new version incorporates the most recently available NTA and population data for 41 countries. Additional data are available on the website. The explorer can be used to assess the implications of alternative fertility projections available from the UN. More information is available in Applications.

Explaining NTA

UNFPA Eastern Europe and Central Asia Regional Office has completed the production of an NTA video clip, which is now accessible on YouTube in Russian and English.

This video is a valuable resource for explaining the value of National Transfer Accounts and how it can be used to understand the generational economy and to develop effective policies in response to rapid demographic change.

EN - https://youtu.be/53TTbWUesTI

RU - https://youtu.be/0vdf2zU0LTM

This video was made possible thanks to the invaluable contributions of Robert Gal, Khuvaydo Shoinbekov, and his colleagues at UNFPA Eduard Jongstra, Michael Herman and Chyngyz Zhanybekov.

If you have any questions or encounter any difficulties opening or viewing the video, please contact Khuvaydo Shoinbekov at shoinbekov@unfpa.org.

Ecuador Joins NTA Network

We are pleased to announce that Ecuador has joined the National Transfer Accounts Network building on several years of work on constructing NTA. The key institution is: Universidad Internacional del Ecuador, Quito, Ecuador. Team members consist of:

- Margarita Velín-Fárez, leader; Assistant Professor at International University of Ecuador (UIDE).

- Luis Rosero-Bixby, advisor; Emeritus Professor, University of Costa Rica

- Daniel Zurita, member; Researcher at Salamanca University (USAL)

- Liliana Roldán-Molina, member; Sub-Director of Operational Risk at Superintendency of Banks

- Francisco Carvajal-Ruiz, member; Senior Consultant

The Third NTA Africa conference will be held from September 6 to 8, 2023 in Saly Portudal, Sénégal

The Demographic Dividend, Generational Economics and Sustainable Development in Africa: Taking stock and building forward better 5 years after the adoption of the AU Roadmap on Demographic Dividend.

Concept Note: NTA_Africa_3_concept_note

Welcoming remarks by Ron Lee and Andy Mason: NTA_Africa_Lee_Mason Welcome

Conference website: https://ntaafrica-conference.creg-center.org/

Building Sustainable Generational Economies: The 14th Global Meeting of the NTA Network, University of Paris - Dauphine, February 14-17, 2023

For more information: https://ntaccounts.org/web/nta/show/Documents/Meetings/14th%20NTA%20Global%20Meeting

Piedad Urdinola has been appointed as the Director of DANE, Columbia's National Statistics Office.

An excellent choice! Congratulations.

Colombia NTA: https://ntaccounts.org/web/nta/show/Colombia%20NTA

Analysis and recommendations in public policy based on National Transfer Accounts for Colombia. Gender gaps, socioeconomic level and evolution over time.

Virtual seminar (in Spanish): https://www.youtube.com/user/UNFPAcolombia

Report: https://poblacion.com.co/ go to "poblacion y desarrollo"

Open access: https://doi.org/10.1111/padr.12469

Supplemental material including PPT and video: https://ntaccounts.org/web/nta/show/Six%20Ways%20Population%20Changes%20Will%20Affect%20the%20Global%20Economy

Policy Insight: https://population-europe.eu/research/policy-insights/population-change-and-economy-results-global-comparative-project

Twitter: https://twitter.com/PopulationEU/status/1494582459869974528?s=20&t=ZVEt2HFTKM3L7zQpJ-psjQ

2021 Asia-Pacific Regional Virtual Meeting

Following three regional workshops on the National Transfer Accounts (NTA) in Asia hosted by UNFPA Asia and Pacific Regional Office together with HelpAge International and the East-West Center held in 2014 (Bangkok), 2015 (Pattaya), and 2017 (Chiang Mai), this virtual meeting is sponsored and co-hosted by UNFPA Asia and Pacific Regional Office together with the Asian Population Association, the East-West Center, HelpAge International, Universitas Gadjah Mada, Universitas Indonesia, and Ministry of National Development Planning for Population and Labor (BAPPENAS), Republic of Indonesia. Over a decade, academics, national officials, experts, and policy planners in Asia have become acquainted with the NTA methodology. While several countries have produced NTA and used the results to support policy development, some countries have limited experience in applying the NTA measures and results for policy development. This virtual meeting offers an opportunity to update state of the art knowledge of NTA implications for policy development.

For NTA Practitioners, Academicians, and Government Officials, 5-6 October 2021: 2021 AP Practitioners agenda

For Policy Planners and Government Official, 7 October 2021: 2021 AP Policy makers agenda

The Second NTA Africa conference will be held from October 27 to 29, 2021 in Somone, Senegal

In a global context marked by the Covid19 pandemic, an unprecedented health crisis with significant economic and social impacts on the African continent, the NTA Africa Network via his Secretariat the Regional Consortium for Research in Generational Economy (CREG), in synergy with the various strategic partners: UNFPA-WCARO and the ECA Sub-Regional Office (BSR / ECA), are organizing the second edition of the NTA Africa conference this year 2021. The NTA Africa 2 conference will be held from October 27 to 29, 2021 in Somone, Senegal.

This conference will be an opportunity for the community of researchers in Africa to play their part in order to make their contributions on issues affecting the socio-economic development of Africa in a context of Covid19.

It is also an open window on the achievements of the National DD Observatories (NDDO) which have been set up in several African countries with the support of the SWEDD Project via the World Bank and UNFPA.

This conference, which will see the participation of policy makers from the countries of the region (Policy makers from 15 countries) as well as other key partners, is an opportunity for the NTA country research teams to present their new research results.

Call for papers: NTA_Africa_2_call_for_Papers

Conference website: https://ntaafrica-conference.creg-center.org/

Ron Lee podcast on East Asia

Ron Lee recently contributed a podcast to the World Politics Review on confronting East Asia's demographic transition. Hear this simulating interview here:

https://www.worldpoliticsreview.com/podcast/29899/confronting-east-asia-s-demographic-transition

Demographic transition: opportunities and challenges to achieve the Sustainable Development Goals in Latin America and the Caribbean

Cassio M. Turra and Fernando Fernandes, under the supervision of Paulo Saad authored this technical report titled “Demographic transition: opportunities and challenges to achieve the Sustainable Development Goals in Latin America and the Caribbean”. The 2030 Agenda for Sustainable Development is susceptible to both demographic changes and how families, governments, and the market distribute resources and time within and between age groups. LAC will soon confront the same economic and fiscal challenges as aging Europe does now, but with three additional challenges. Population aging will take place faster than it has in Europe, at lower levels of economic development, and under high and persistent levels of inequality. In this ECLAC/CEPAL technical report, the authors explore potential associations between demographic changes, National Transfer Accounts (NTA), and the Sustainable Development Goals (SDGs) in several countries. They also offer a set of recommendations in the context of critical demographic changes.

NTA Research featured in UN Economist Network report on megatrends

In a report prepared for the 75th anniversary of the UN, the UN Economist Network examined five megatrends: climate change; demographic shifts, particularly population ageing; urbanization; the emergence of digital technologies; and inequalities –that are affecting economic, social and environmental outcomes. NTA research was featured in Chapter 3, "Demographic trends in an ageing world" to explain the first and second demographic dividends. The demographic dividend frameworks show the opportunities and challenges that come with ageing. The chapter was prepared with inputs from the Population Division (PD) of UN-DESA, the UN regional commissions, the UNFPA, UN-Women, UN-Habitat, FAO and UNCTAD. United Nations personnel and NTA network members and friends Jorge Bravo, Tim Miller, Nicole Lai, Yumiko Kamiya, and others contributed comments, suggestions, analysis, data and references.

Global Meeting on Population and the Generational Economy, August 3-7, 2020

The first virtual meeting of the global NTA network has concluded. More than 160 people participated in the conference held over a five day period.

Agenda, Abstracts, and Presentations

The agenda, abstracts, and presentations from the Global Virtual Meeting on Population and the Generational Economy are available here:

https://ntaccounts.org/web/nta/show/Documents/NTA2020%20Agenda

Global NTA Satellite Meetings

The first global NTA satellite meeting has been completed. Thank you to the many NTA members and others who participated in the two workshops hosted by Ron Lee and Gretchen Donehower at CEDA. The agendas and materials are posted on the meeting website.

Micro-Distributional NTA: Investigating Inequality, Human Capital, and Changing Population Composition in a Longitudinal Contest, May 4/5 and 11/12, 2020

Liberia: Workshop On National Transfer Accounts in Monrovia

The United Nations Economic Commission for Africa (UNECA), through its Sub-regional Office for West Africa (SRO/WA), held a three-day capacity-building workshop in Liberia to support understanding of NTA in Liberian government institutions. (October 2020)

Intergenerational Resource Sharing and Mortality in a Global Perspective

NTA members Tobias Vogt, Fanny Kluge, Ronald Lee have recently published an article in the Proceedings of the National Academy of Sciences (US). They find that willingness to share has been critically important for people's past evolutionary success and present daily lives. They document a strong linear relationship between the public and private sharing generosity of a society and the average length of life of its members. Findings from 34 countries on six continents suggest that survival is higher in societies that provide more support and care for one another. They suggest that this support reduces mortality by meeting urgent material needs, but also that sharing generosity may reflect the strength of social connectedness, which itself benefits human health and wellbeing and indirectly raises survival.

The full citation for the article is: Tobias Vogt, Fanny Kluge, Ronald Lee. Intergenerational resource sharing and mortality in a global perspective. Proceedings of the National Academy of Sciences, 2020; 201920978 DOI: 10.1073/pnas.1920978117.

ECA's West Africa Office Undertakes Training in Generational Economics and National Transfer Accounts Methodologies

Experts from the United Nations' Economic Commission for Africa's Sub-Regional Office for West Africa participated virtually in a capacity building workshop on generational economics and National Transfer Accounts (NTA) methodologies. Organized in partnership with the Regional Consortium for Research in Generational Economics (CREG), the workshop, was aimed at strengthening the capacities of staff to undertake activities that would support member states to integrate demographic dividend issues in their development policies. Staff undertook training along five modules, namely: Theory of Generational Economics, Consumption Profiles, Labor Income Profiles, Life-Cycle Deficit and Demographic Dividend Profiles. (September 2020)

Release of NTA Indicators 2020

NTA time series indicators for 186 countries from 1950-2100 have been released.

Link: NTA Indicators

United Nations' World Population Ageing 2019 Highlights NTA Data

The United Nations' Population Division launched World Population Ageing 2019 on 10 October 2019 at an event commemorating the UN International Day of Older Persons. UN Population Affairs Officer Mun Sim Lai (Nicole) thanked Michael Abrigo, Andy Mason, and Ron Lee for providing NTA data estimates, which formed the major chapter of the report, and Andy and Ron for reviewing the chapter on NTA estimates.

NTA Researcher Receives Commendation from President of South Korea

On 29 August 2019, during the celebration of South Korea's Statistics Day, NTA Chair Sang-Hyop Lee received a Presidential Commendation Award at the Government Complex in Daejeon. The Korean Statistics Commissioner presented the award, which stated: "We are presenting this award for your substantial contribution to national industrial development through the production of reliable statistics: President Moon Jae-In."

On 29 August 2019, during the celebration of South Korea's Statistics Day, NTA Chair Sang-Hyop Lee received a Presidential Commendation Award at the Government Complex in Daejeon. The Korean Statistics Commissioner presented the award, which stated: "We are presenting this award for your substantial contribution to national industrial development through the production of reliable statistics: President Moon Jae-In."

Demographic Dividends Featured in SDGs: Transforming Our World

The United Nations Association-UK has just released a comprehensive report and website that provide analysis and recommendations on achieving the Sustainable Development Goals. The report includes an article on demographic dividends authored by Andrew Mason and Sang-Hyop Lee. Mason and Lee argue that "Progress toward achievement of the Sustainable Development Goal (SDG) targets is closely linked to demographic trends.... The goal should be to establish public programmes that provide some basic level of security but that can be sustained in the years ahead."

Statistics Korea Releases NTA Data

For the first time, Statistics Korea has made data from the National Transfer Accounts available as a component of official government statistics. The data, which show how finances are redistributed between age groups, will be used as a basis for developing national pension and health insurance policies. Korean media announced the release on 22 January 2019. See The World on Arirang.

New Results for Moldova

With support from UNFPA-Moldova, Expert-Group has completed NTA estimates and a comprehensive analysis of the demographic dynamics in the Moldova economy. The report and a NTA dashboard are available here: Outside Publications that Feature NTA Results

New Global Demographic Dividend Estimates

New estimates of demographic dividends for 166 countries around the world are now available. The estimates were constructed in cooperation with the United Nations Population Division in conjunction with the 50th United Nations Commission on Population and Development. More information including downloadable data are available here: Dividend Data

Counting Women's Work Project

| This NTA project has developed methods for using time-use data to estimate the monetary value of unpaid services produced and consumed by gender and age groups. Combining estimates for the market and the household with the age dimension in a cross-national comparative context will bring women’s total economic contributions into view and establishes sound terms of public discussion and policy debate around issues of gender and the economy. For more information see NTA Bulletin 11: Counting Women's Work: Measuring the Gendered Economy in the Market and at Home and the CWW website. |

Recent NTA Publications

NTA Bulletin 13: What Do We Learn When We "Count Women's Work?"

| Standard measures of economic activity leave out one extremely important component of production and consumption―the unpaid care and household services most often provided by women. Adding unpaid services to measures of economic activity shows that women are not an "untapped" source of labor. Policymakers looking to increase female participation in the formal labor market need to keep in mind that women are already working as much or more than men. In some societies, the time that adolescent girls and young women spend on unpaid housework may be limiting the time they have available to pursue an education. Taking account of unpaid care and housework substantially increases the cost of raising children but also shows that the elderly, who often contribute substantially to care and housework, are not as heavy a burden on their families as sometimes suggested.% Download PDF: NTA Bulletin 13 All issues of the NTA Bulletin |

NTA Bulletin 12: Sharing the Demographic Dividend: Findings from Low- and Middle-Income Countries in Asia

| Recent work by NTA teams in Asia has shed light on how both the contributions and benefits associated with population change are shared-—among age groups, between genders, among income groups, and between urban and rural residents. Better insights into these distributional issues can help policymakers maximize the potential of demographic change to stimulate economic growth and reduce the disparities among population groups. Download PDF: NTA Bulletin 12 All issues of the NTA Bulletin |

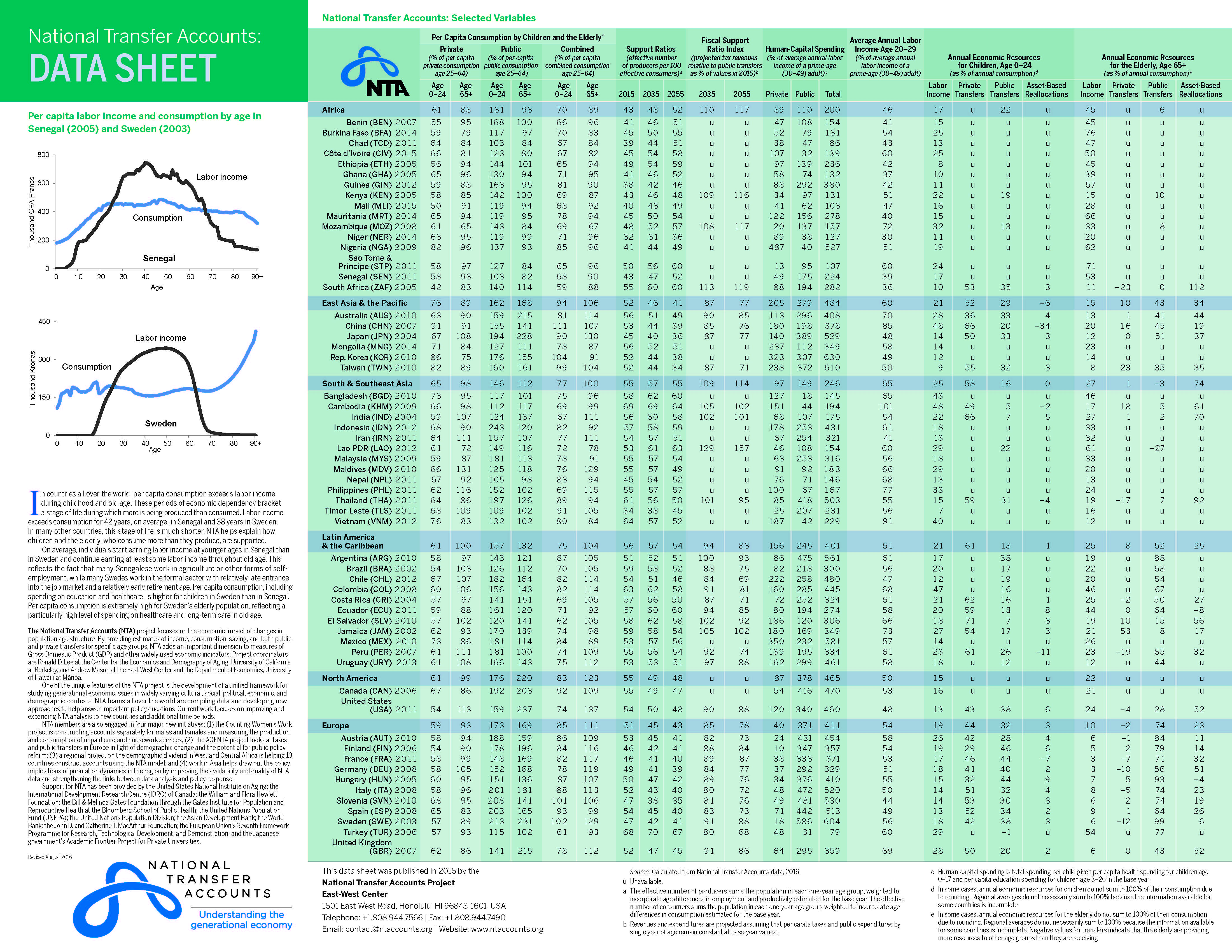

Second National Transfer Accounts Data Sheet: August 2016

| NTA's second data sheet provides estimates of 23 variables for 59 countries in Africa, East Asia and the Pacific, South and Southeast Asia, Latin America and the Caribbean, North America, and Europe. Estimates cover per capita consumption by children and the elderly, support ratios, fiscal support ratios, human-capital spending, labor income of young adults, and sources of economic support for children and the elderly. Downloads: PDF file: NTA Data Sheet 2016 Excel file: NTA Data Sheet 2016 excel |

For a more complete list of NTA publications, go to the Publications section.

Recent Publications by NTA Members

2020

Lee, Ronald, Andrew Mason, and Gretchen Donehower (2020). Changes in Intergenerational transfers in the United States from 1961 to 2016: Follow-up Report. Salamanca: International Centre on Aging (CENI).

CENI has published a follow-up report on this NTA research. Versions in Spanish, Portuguese, and English are available on the CENI website.

Tobias Vogt, Fanny Kluge, Ronald Lee. Intergenerational resource sharing and mortality in a global perspective. Proceedings of the National Academy of Sciences, 2020; 201920978 DOI: 10.1073/pnas.1920978117.

2019

Dramani, Latif (2019). Dividende démographique et développement durable au Sénégal. Volume 1. and Volume 2. Dakar: L'Harmattan.

Cet ouvrage propose un changement paradigmatique, après que les nombreuses politiques de développement ont manqué à la promesse de la prospérité partagée dans les pays en développement. Son ambition est d'accompagner efficacement les gouvernants par une simplification des méthodes, en leur proposant des outils adaptés à l'élaboration de politiques multisectorielles.

Hammer, Bernhard, Ronald Lee, Alexia Prskawetz, and Miguel Sanchez-Romera, guest editors (2019). Vienna Yearbook of Population Research. Volume 17.

This special issue of the Vienna Yearbook contains chapters derived from the EU-funded AGENTA project, which uses and extends the methods of the National Transfer Accounts (NTA) project to shed light on the ways in which the families and governments of Europe draw on the earnings of the working-age population to support both children and the elderly. One chapter also discusses transfers of informal care time in the United States. Contributors include several NTA members.

Lee, Ronald, and Andrew Mason, editors and lead authors (2019). Population aging and the generational economy: A global perspective (In Farsi). Translated by Majid Koosheshi and Leili Niakan.

This NTA classic has recently been translated into Farsi.

Mason, Andrew, and Sang-Hyop Lee (2019). Macroeconomic impacts and policies in aging societies. In Aging societies: Policies and perspectives. Tokyo: Asian Development Bank Institute.

Will population aging lead to an economic crisis with tepid economic growth, generational inequality, unsustainable public finances, and overly burdened families? Answering these questions definitively requires data and analysis that have not been available in many countries. The evidence that is available, however, indicates that countries with moderate population aging can pursue policies that will capitalize on the benefits and minimize the costs of population aging. Countries with very low fertility and a severely aging population will likely face serious economic challenges.

Mason, Andrew, and Ronald Lee (2019). Intergenerational transfers in the United States. International Centre on Aging (CENIE).

The United States is unique among high-income countries in its heavy reliance on assets and its low reliance on public transfers to fund old-age needs. Among 65-year-olds, asset-based reallocations support 86 percent of the lifecycle deficit, but the role of public transfers increases steadily with age.

Mason, Andrew, and Sang-Hyop Lee (2019). Demographic dividends: Policies based on an understanding of population dynamics will help countries achieve the SDGs. In SDGs: Transforming our world. 2019 edition. United Nations Association. UK.

Taking advantage of the opportunities and responding to the challenges presented by the demographic transition require forward-looking policies that take account of population dynamics.... The success of the 2030 Agenda for Sustainable Development, which pledges that no one will be left behind, is strongly bound to anticipating and planning for the effects of the demographic transition that will unfold during the SDG period.

'''Merette, Marcel, and Julien Navaux (2019). Population aging in Canada: What life cycle deficit age profiles are telling us about living standards. 'Canadian Public Policy/Analyse de politiques.' June:192-211.'''

This article assesses age profiles for labor income, consumption, and the lifecycle deficit in Canada from 1998 to 2013. it shows that the increase in the lifecycle deficit at young and old ages was not entirely compensated by an increase in the lifecycle surplus of working-age groups.

Narayana, M.R. (2019). Fiscal policy, demographic transition and public spending on education: New macroeconomic evidence for higher education from India. 'Journal of Education Finance.' 44(4): 405-22.

This paper establishes the empirical relationship between fiscal policy, the demographic transition, and public spending on education in India, with special reference to higher education. Overall results indicate that, other things being equal, the demographic transition results in (a) additional budgetary resources for higher education without any additional taxation, cut in expenditure benefits, or public debt, and (b) a decline in public education expenditure for all levels of education and for higher education in particular.

For a more complete list of scholarly publications by NTA members, go to the Publications section.

NTA Classics

|

|

| NTA Manual | Population aging and the generational economy |

For a more complete list of NTA publications, go to the Publications section.

Other Publications that Feature NTA Analysis

Olanrewaju Olaniyan, Adedoyin Soyibo, et al., 2018. Harnessing the Demographic Dividend for Sustainable Development: 2016 Demographic Dividend Report of Nigeria

This comprehensive report on the Demographic Dividend incorporates up-to-date demographic data and newly available NTA estimates for 2016.

Demographic dividend Nigeria 2016

2015-2016 World Bank and International Monetary Fund Global Monitoring Report

| The 2015-2016 World Bank and International Monetary Fund Global Monitoring Report (GMR) focused on demographic trends that will impact future economic growth and development. Analyses of NTA data took center stage in the discussion of how changing population age structures shape development trajectories in many countries. GMR 2015/2016 link, and online snippets are available HERE. |

Website on the Demographic Dividend

A website, co-hosted by the Bill & Melinda Gates Institute for Population and Reproductive Health at the Johns Hopkins Bloomberg School of Public Health and the Population Reference Bureau, prominently features NTA's work on the Demographic Dividend in Africa. The objective is to host resource materials available from a number of organizations engaged in research, advocacy, and policy work related to the demographic dividend. Organizations are encouraged to share their collective and individual contributions to the research literature and base of policy communication materials on the demographic dividend by emailing either a link or a PDF file.

Video featuring NTA work on the Demographic Dividend

The Graying of the American Economy: Fiscal Math Is Daunting: Federal Reserve Bank of Atlanta's 2015 Annual Report

Gretchan Donehower provided NTA information to the Atlanta Federal Reserve Bank on taxes and social contributions paid and public benefits received by age. Two NTA charts are featured in the on-line write-up of the bank's 2015 annual report.

Recent NTA Meetings

NTA: Principles, Methodology, and Construction, Moscow NRU HSE, 20-22 June 2017

A Workshop on National Transfer Accounting: Principles, methodology, and the main problems of construction was organized in Moscow on 20-22 June 2017. It was held at the National Research University Higher School of Economics. The participants represented 12 countries of Eastern Europe and Central Asia.

NTA Conference in Europe: Selected Presentations Available

The Hungarian Demographic Research Institute recently hosted a conference on National Transfer Accounts as part of the European FP7 AGENTA project funded by the European Commission. All presentations from the open session of this 3rd AGENTA Project Meeting, held in Budapest on 9 March 2017, are available online. More information about the Agenta Project is also available.

For more information about NTA meetings, go to the Meetings section.

NTA in the News: Recent Articles

13 January 2022 Reaping's India's Demographic Dividend, The Hindu News

2 September 2020: Are Ungenerous People More Likely to Die Young?, Psychology Today.

Intergenerational sharing and longevity may be linked, a 34-country study finds. For this study, a three-person international team of researchers that included Tobias Vogt and Fanny Kluge of the Max Planck Institute for Demographic Research in Germany and Ronald Lee of the Demography Department at the University of California, Berkeley, analyzed swaths of data from the National Transfer Accounts: Understanding the Generational Economy project. They report that higher levels of intergenerational resource sharing are linked to lower mortality rates across a society. These findings were published on August 31 in Proceedings of the National Academy of Sciences.

2 September 2020: Science Says Sharing More Could Be the Secret to Living Longer, MarthaStewart.com.

A new study published in the journal PNAS (Proceedings of the National Academy of Sciences of the United States of America) suggests that those who share more of their wealth also live longer. The team of researchers—led by Fanny Kluge and Tobias Vogt—found a strong relationship between a society's generosity and the average life expectancy of its members. In the study, researchers used data from 34 different countries from the National Transfer Accounts project to assess how resources were redistributed.

14 July 2020: NTA findings featured in Pakistan, On World Population Day, Business Recorder.

Dr. Durre Nayab has published a pioneering study based on construction of national transfer accounts, the first such exercise in Pakistan, in collaboration with her co-author Omer Siddique -– also from the Pakistan Institute of Development Economics. The study, titled National Transfer Accounts for Pakistan: Estimating the generational economy, essentially takes a look at the size of wealth flows from one generation to another; at how much people earn and consume at every age; and at how population growth and changing age structure can influence economic growth, public finances, and other ancillary macroeconomic affairs.

12 July 2020: "Apartheid and Jim Crow are really no different:" Why George Floyd's death reverberated in Africa, WCSJ News.

The system of apartheid in South Africa was dismantled in the early 1990s through a series of bilateral negotiations between the National Party and the African National Congress, the leading anti-apartheid political movement at the time. Nelson Mandela, president of the African National Congress party, was then elected as the country's first Black head of state during the 1994 general election. However, experts said white South Africans have retained economic, social and cultural power, enjoying a far better standard of living and quality of life than their non-white counterparts. National Transfer Accounts data from 2015 show the average lifetime work-related earnings for whites peaks at over 300,000 South African rand per year, while for non-whites the peak is 70,000, according to a recent paper by the United Nations University World Institute for Development Economics Research.

19 December 2019: NTA featured in Pakistan report launch in Daily Times. Keynote address by Kanwal Shauzeb.

Kanwal Shauzeb in her keynote address said, “The construction of the National Transfer Accounts for Pakistan by PIDE would help in understanding how people at different ages produce and consume, and fulfill their deficit. In addition, it would support the government in better allocation of resources as the NTA shows in detail how public and private finances are allocated and used. Evidence based policy-making is imperative for it to be sound and effective, and NTA provides evidence regarding a lot of important factors including health and education."

15 December 2019: Average S. Korean enjoys only 32 years of a financial surplus in lifetime. In Hankyoreh.

First published in January 2019, National Transfer Accounts are an index that helps identify how demographic changes and other factors are driving trends in the distribution of resources to each age group.“Public transfers, which collect taxes and then return them as welfare benefits, have essentially surpassed the scale of private support through family relationships. Amid increasing welfare for the elderly, who depend more on public than private transfers, we’re seeing public transfers increase at a higher rate,” said Kim Dae-yu, head of income statistics development at Statistics Korea.

7 October 2019: Counting women's work in University of Cape Town News. By Morné Oosthuizen.

In South Africa, unpaid housework and caregiving—provided almost entirely by women—accounts for about one-fourth of 27 percent of GDP. Researchers recommend policies to support market-provided childcare for adult women and for younger women whose final school years might be interrupted by family care responsibilities. They also suggest policies that encourage men to take more active roles in their households, especially childcare, and greater work flexibility for all parents.

18 March 2019: Population aging and fiscal challenges in China in N-IUSS: IUSSP's online news magazine. By Feng Wang, Ke Shen, and Yong Cai.

Within the next 15 to 30 years, China will face unprecedented fiscal pressure to fund its social welfare programs in response to accelerating population aging and inevitable welfare expansion.

10 March 2019: National Transfer Accounts in Spain: 1900-1970 (in Spanish) on CENIE: Centro Internacional sobre el Envejecimiento website. By Concepcion Patxot Cardoner.

El objetivo de este proyecto es hacer un análisis histórico de la evolución del estado del bienestar en España y su relación con la evolución económica y demográfica.

26 February 2019: China isn’t having enough babies in The New York Times. An opinion piece by Wang Feng and Yong Cai based in part on NTA research.

Changing demographics create major political tests for China’s leaders, present and future. One is how to maintain growth as the population keeps aging and the work force’s relative size keeps shrinking. Another is how to deliver the economic and social benefits that Chinese people now expect from the state.

22 January 2019: Statistics Korea releases NTA data in The World on Arirang.

For the first time, Statistics Korea has made data from the National Transfer Accounts available as a component of official government statistics. The data, which show how finances are redistributed between age groups, will be used as a basis for developing national pension and health insurance policies.

27 May 2018: The young get more than the old out of society, but they get less from the state in The Independent.

Based on NTA research, Pieter Vanhuysse finds that Europe is a continent of pro-elderly welfare states, embedded within societies composed of strongly child-oriented families.

4 April 2018: The case for fewer babies in The Korea Times.

In this article, Ronald Lee argues that the costs of Korea's low birth rate may be somewhat exaggerated.

8 July 2017: The Economist special report on aging and longevity draws on NTA analysis.

Two articles in this special report quote NTA members Andrew Mason and Ronald Lee:

- Footloose and fancy-free: Retirement is out, new portfolio careers are in.

- Your money and your life: Financing longevity.

A fuller list of media coverage of NTA is at NTA in the news.

The website was developed and is maintained by SchemeArts.